Web3, the next evolution of the internet, is rapidly emerging as a transformative force, promising a more decentralized, transparent, and user-centric online experience. Built on blockchain technology, Web3 aims to shift power from centralized entities back to individuals, opening up a myriad of opportunities for innovation, investment, and participation.

Exploring the Web3 Ecosystem

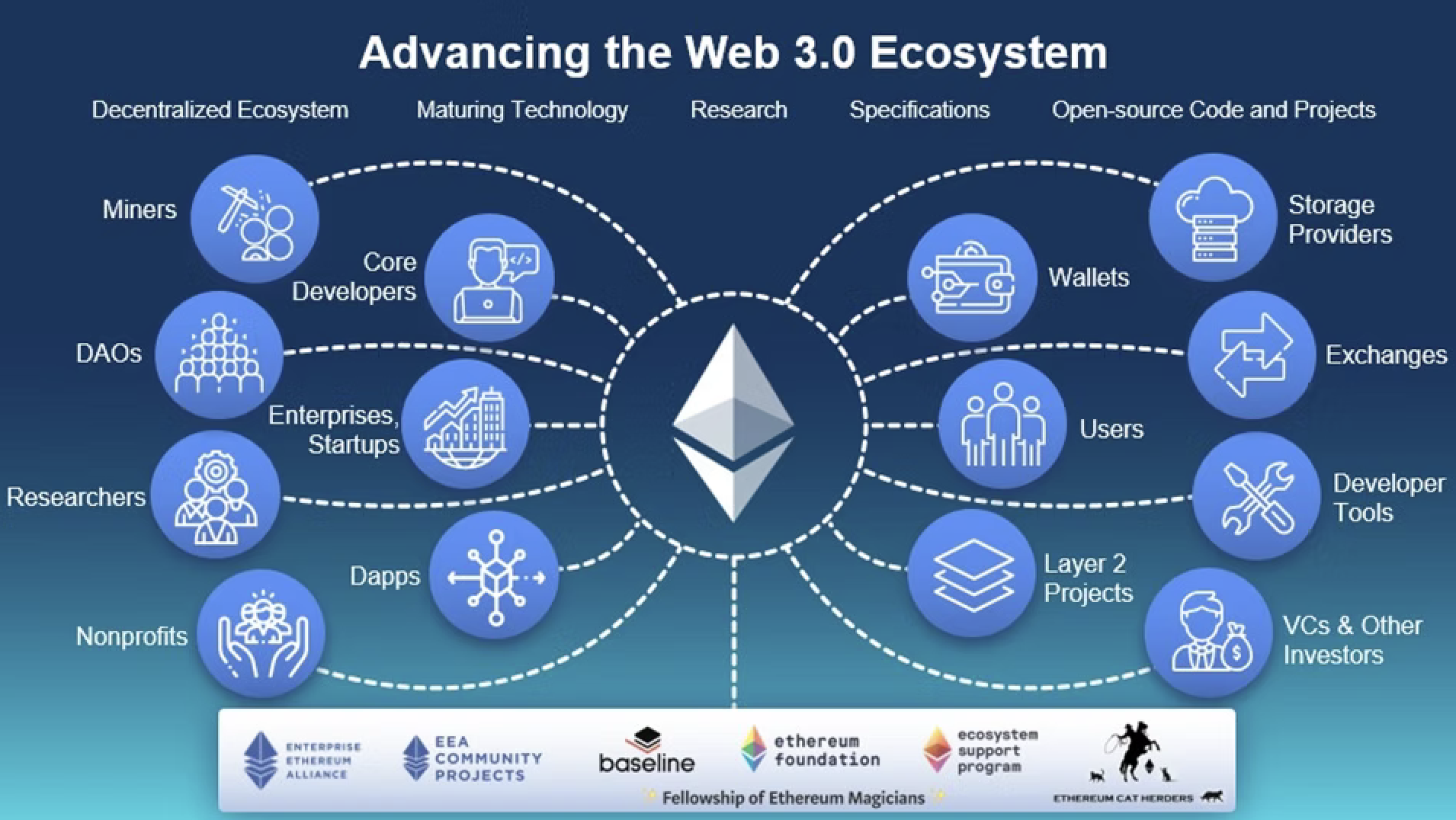

At its core, Web3 leverages decentralized technologies like blockchain, smart contracts, and cryptocurrencies to create a new paradigm for online interactions. Unlike Web2, where data and applications are largely controlled by a few tech giants, Web3 empowers users with genuine ownership of their data and digital assets. This shift manifests across several key areas:

-

Decentralized Finance (DeFi): Imagine financial services — lending, borrowing, trading — operating entirely on a blockchain, without the need for traditional banks or intermediaries. DeFi protocols are building this future, offering new ways to manage and grow digital assets.

-

Non-Fungible Tokens (NFTs): More than just digital art, NFTs are unique digital assets representing ownership. They can range from artwork and collectibles to virtual land in metaverses, signifying a new era of digital property rights and creative monetization.

-

Metaverse: These immersive virtual worlds are not just for gaming; they are evolving into digital economies where users can interact, socialize, conduct commerce, and even work. Your digital identity and assets seamlessly cross these virtual boundaries.

-

Decentralized Autonomous Organizations (DAOs): Picture an organization run entirely by its community, with rules encoded on a blockchain and decisions made by token holders. DAOs represent a groundbreaking model for governance, from investment funds to social clubs.

-

GameFi & Play-to-Earn (P2E): This fusion of gaming and decentralized finance allows players to earn cryptocurrencies and NFTs through gameplay, transforming traditional gaming into a new economic model where time and skill translate into tangible digital assets.

Image: Enterprise Ethereum Alliance

Investment Opportunities in Web3

The growing nature of Web3 presents significant investment opportunities for those understand its unique dynamics. Rather than just broad categories, let's explore more focused areas:

-

Investing in Core Infrastructure: Think of the Web3's "plumbing"(the underlying layer that facilitates interactions between different parts of the Web3 ecosystem.) Investing in Layer-1 blockchains (like Ethereum, Solana, Avalanche) or Layer-2 scaling solutions is akin to investing in the internet's early protocols. These are critical for the entire ecosystem's growth and efficiency.

-

DeFi Protocols: While high-yield opportunities exist, focusing on established DeFi protocols with robust security audits, transparent governance, and a proven track record can offer more stable exposure. Look for those solving real-world financial problems or significantly improving capital efficiency.

-

NFTs and Metaverse Projects: Beyond speculative art, consider NFTs that offer tangible utility within an ecosystem, such as access passes, membership rights, or in-game assets that genuinely enhance user experience. Investing in metaverse platforms with strong development teams, clear roadmaps, and growing user basesprovides exposure to the future of digital interaction and commerce.

-

GameFi & P2E Innovations: The P2E model is evolving. Seek out GameFi projects that prioritize engaging gameplay alongside their economic models. Success here often lies with games that can attract and retain players not just for financial incentives, but for the fun of playing, hinting at long-term sustainability.

Image: bdtask

Unique Risks in Web3 Investment

Despite the exciting potential, Web3 investing is fraught with risks that exists in any new asset class, such as market volatility, regulatory Uncertainty, etc. Here we will introduce specific, often severe, risks that demand particular attention in Web3 investment:

-

Smart contracts are vulnerable.

Unlike traditional software, smart contracts on a blockchain are immutable once deployed. A flaw or bug in their code can lead to irreversible loss of funds, as seen in numerous DeFi hacks and exploits. Thorough audits by reputable firms are crucial but don't guarantee immunity. Always verify a project's audit history and ongoing security practices.

-

Liquidity issues enfeeble investors.

Some Web3 assets, especially those in niche projects or less popular NFTs, may suffer from low liquidity, making it difficult to buy or sell them quickly without impacting their price. Even worse are "rug pulls," where developers suddenly abandon a project and withdraw all pooled liquidity, leaving investors with worthless tokens. Look for transparent liquidity provisions, locked liquidity pools, and strong community trust.

-

Less regulation is a double-edged sword.

While the lack of clear global regulations allows for innovation, sudden shifts in government policy, taxation laws, or even outright bans in certain jurisdictions can severely impact asset values and project viability. Staying informed about regulatory developments in key markets is essential.

-

Fragmentation may suffer.

The Web3 ecosystem is still fragmented, with various blockchains and protocols not always communicating seamlessly. This can lead to asset trapped on one chain or complex bridging processes that introduce additional risks. The success of some projects relies heavily on future interoperability solutions.

-

Be aware of scams and frauds.

The decentralized nature means YOU are your own bank. Phishing attacks targeting wallet seed phrases, malicious smart contracts that drain wallets upon approval, and social engineering scams are rampant. Education on cybersecurity best practices, using hardware wallets, and verifying every transaction are crucial.

Image: Pixeplex

How to Participate in the Web3 Ecosystem

Beyond just investing, actively engaging with the Web3 ecosystem can provide invaluable insights and opportunities:

-

Deep Dive into Education: Don't just follow the headlines. Dedicate time to truly understand blockchain fundamentals, cryptography, tokenomics, and the mechanics of smart contracts. Reputable online courses, project whitepapers, and in-depth analyses are your best friends.

-

Hands-on dApp Experience: The best way to learn is by doing. Experiment with decentralized applications (dApps) – try making a swap on a DEX, minting a free NFT, or participating in a small DAO vote. This firsthand experience demystifies the technology and helps you identify truly innovative projects.

-

Engage with Communities & Contribute: Join the vibrant Web3 communities on platforms like Discord, Telegram, and X (formerly Twitter). Ask questions, participate in discussions, and even contribute to open-source projects or DAOs. Being part of the community provides early access to information and networking opportunities.

-

Explore Web3 Career Paths: The space is growing rapidly, creating demand for new skills. Consider how your existing expertise (e.g., marketing, design, community management, legal, software development) can be applied to Web3 projects, DAOs, or startups.

-

Develop Robust Security Habits: Given the unique risks, you must prioritize security. Use hardware wallets, never share your seed phrase, be wary of unsolicited links, and double-check every address and transaction before approving.

In conclusion, Web3 is more than a technological advancement; it's a philosophical shift towards a more equitable and open internet. While the journey will undoubtedly have its bumps, those who approach it with a combination of informed understanding, strategic investment, and active participation will be best positioned to thrive in this decentralized future.