As the Web3 space continues its rapid development, security vulnerabilities remain a persistent threat to the industry. According to a report by BlockBeats, the Decentralized Finance (DeFi) platform BetterBank on the PulseChain network suffered a malicious attack, resulting in a significant asset loss of approximately $5 million.

Attack Details: Asset Movement and Market Ripple Effects

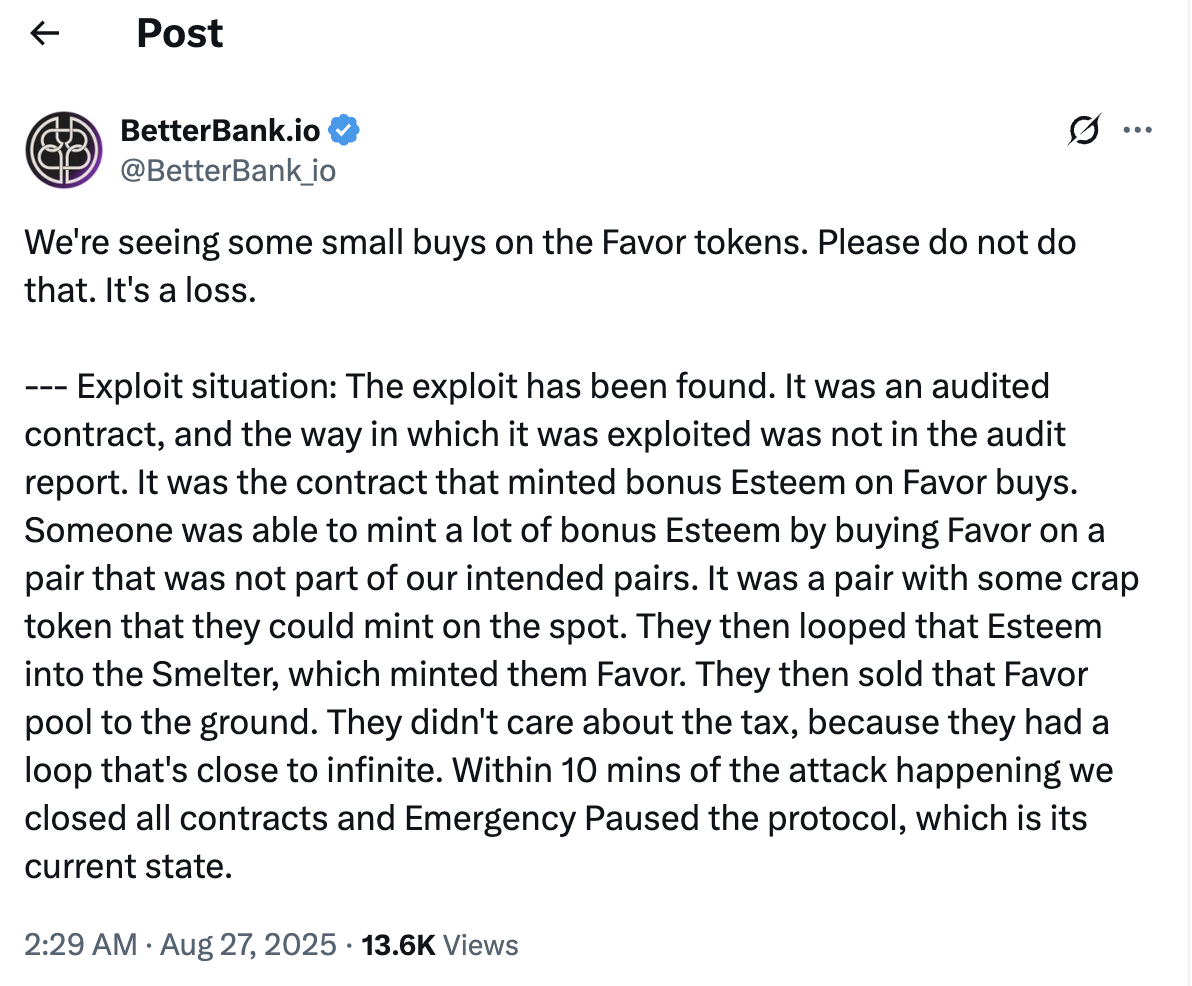

(Source:BetterBank.io)

Based on on-chain tracking, the security incident occurred on August 27. The attacker exploited a vulnerability within the protocol and successfully stole assets worth millions of dollars. After the exploit, the attacker quickly moved the funds, swapping a portion of the stolen assets for 215 Ethereum (ETH), valued at approximately $983,000 at the time.

This event has not only dealt a devastating blow to the BetterBank project but has also once again raised deep concerns across the market about the security of cryptocurrencies. At the time of the incident, the Ethereum market was also experiencing volatility. According to CoinMarketCap data, Ethereum's price was $4,330.99, having dropped by 4.13% in a 24-hour period, which further fueled market apprehension.

The Ongoing Challenge of Web3 Security

The attack on BetterBank serves as a stark reminder of the security challenges within the decentralized finance space. Since the core of a DeFi protocol—the smart contract—is public and immutable, any vulnerabilities in the code can be exploited by attackers, making the recovery of stolen funds extremely difficult.

This incident is a wake-up call for all Web3 projects and investors. For project teams, strengthening security audits, implementing multi-signature mechanisms, establishing bug bounty programs, and creating a rapid-response team are all necessary steps to safeguard user assets. For users, conducting thorough due diligence before participating in any DeFi protocol and only investing funds they can afford to lose are crucial risk management principles.

The BetterBank hack reminds us that while Web3 brings unprecedented financial innovation, its technology and security infrastructure are still in an early stage. While enjoying the convenience of decentralization, a strong awareness of risk and proactive security measures should always be a top priority.