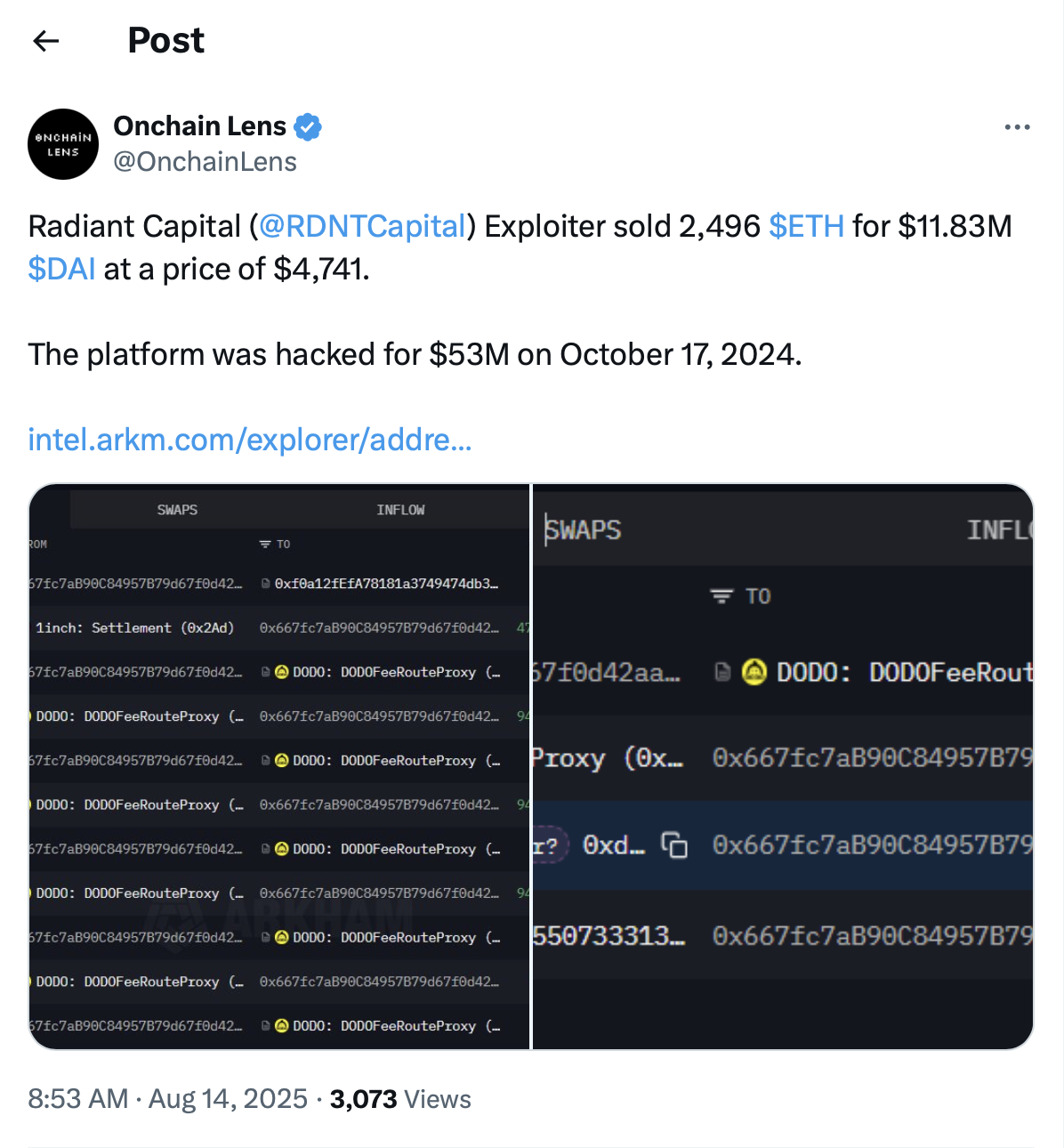

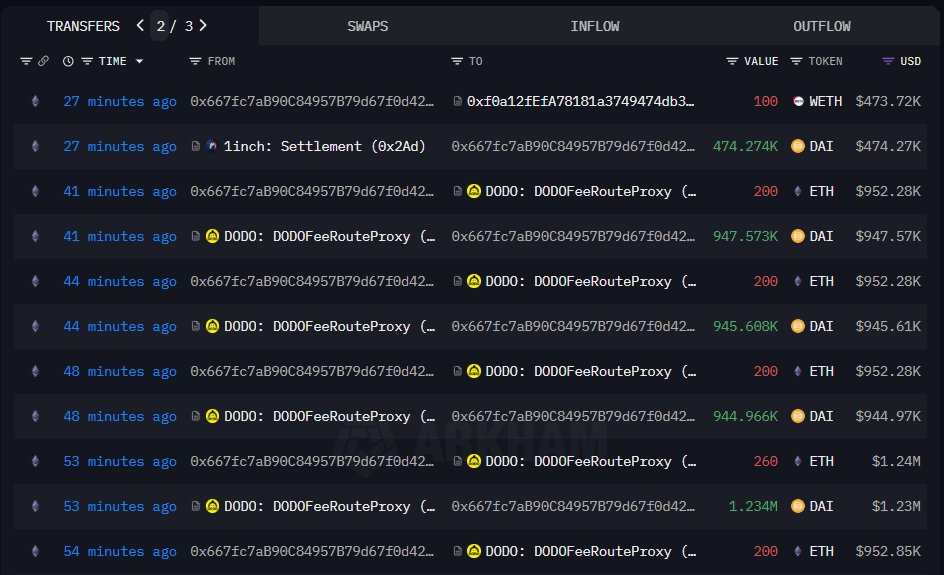

A cyber-attack on the decentralized finance (DeFi) protocol Radiant Capital was revealed on X on August 14,2025. This attack serves as a stark reminder of the persistent security threats within the crypto landscape. On October 17, 2024, the protocol suffered a breach resulting in a loss of $53 million. Following the attack, the perpetrator moved quickly to liquidate a significant portion of the stolen assets, selling 2,496 ETH at an average price of $4,741, which was then converted into 11.83 million DAI. This incident, reported by Foresight News, underscores critical vulnerabilities within the DeFi ecosystem and highlights the sophisticated methods employed by attackers to evade asset recovery. From the perspective of a leading crypto exchange, this event is not just another headline; it's a critical case study that informs our ongoing efforts to safeguard users and the broader industry.

Credit: @OnchainLens on X (Twitter)

Anatomy of an Attack and Its Aftermath

The technical nature of the Radiant Capital breach has sent ripples through the DeFi community. While the specific exploit details are under investigation, the swift action of the attacker in liquidating the stolen funds demonstrates a clear, premeditated strategy. The conversion of a volatile asset like ETH into a stablecoin like DAI is a common tactic used by bad actors to lock in their gains and make the stolen funds more difficult to trace and seize. This rapid on-chain activity presents a formidable challenge for security teams and law enforcement agencies trying to recover the assets. The transaction flow—from exploit to liquidation—is a well-worn path that highlights the need for real-time monitoring and robust, proactive measures across the crypto space.

The Broader Implications for DeFi Security

The Radiant Capital attack is symptomatic of larger systemic issues facing the DeFi sector. The very nature of decentralized protocols, built on open-source code and composable smart contracts, creates a fertile ground for sophisticated exploits. While this design promotes innovation and transparency, it also exposes projects to risks that can be difficult to mitigate fully. Common attack vectors, such as smart contract vulnerabilities, flash loan exploits, and oracle manipulation, continue to pose a significant threat. Each new attack provides a valuable lesson, reinforcing the need for continuous security audits, bug bounty programs, and enhanced protocol monitoring. For users, this event is a crucial reminder that the promise of "permissionless" finance comes with a heightened degree of personal responsibility. Users must conduct thorough due diligence on the protocols they interact with, scrutinizing audit reports and understanding the inherent risks involved.

The Role of Centralized Exchanges in Mitigating Threats

While the attack occurred on a decentralized protocol, centralized exchanges (CEXs) like ours play a critical role in the aftermath and in preventing future incidents. When large-scale hacks occur, the stolen assets often make their way to CEXs for further liquidation or off-ramping. Our security teams work tirelessly, employing sophisticated on-chain analytics and AI-powered monitoring tools to track the movement of illicit funds. This enables us to freeze suspect accounts and collaborate with law enforcement agencies to aid in the recovery of stolen assets. This incident further validates our strategy of maintaining close cooperation with other industry players, including security firms and law enforcement, to share threat intelligence and create a more resilient ecosystem. It's a collaborative effort, and the ability to act swiftly and decisively is paramount.

Looking Ahead: Building a More Resilient Ecosystem

The battle against malicious actors in the crypto world is ongoing, and it requires a multi-pronged approach. The industry must move beyond reactive measures and invest heavily in proactive security. This means not only technical advancements in blockchain security but also fostering a culture of vigilance and accountability. Protocols must prioritize security over speed to market, and users must be educated about the risks. The Radiant Capital hack, while a painful loss for the community, serves as a powerful catalyst for change. By learning from these incidents, sharing knowledge, and enhancing our collective defenses, we can build a more secure and trustworthy environment for the future of finance.